No matter what kind of investment property you own, the most important metric for measuring success is cash flow. You need to make sure the properties you’re investing in will generate a profit — otherwise, you’ll quickly find yourself with a portfolio that’s draining your bank account instead of growing it.

But luckily, profitability isn’t something you have to leave to chance. Before you pull the trigger on an investment property, you can read the cash flow projection (also known as a pro forma) to evaluate the property’s overall profitability. A pro forma analysis can give you invaluable information on the income potential of a property, potential costs, and whether it’s a solid long-term investment. Even if you’re merely considering buying a property, it’s something you need to explore.

But reading a real estate pro forma isn’t exactly something they teach you in high school, and a lot of investors don’t even know where to start to figure out how to read the report or determine pro forma cash flow.

Let’s take a deeper look at real estate pro forma, how to read the report, and what to look out for to make sure you’re investing in a profitable property (and not one that will suck you dry):

A Deeper Look at a Pro Forma Report

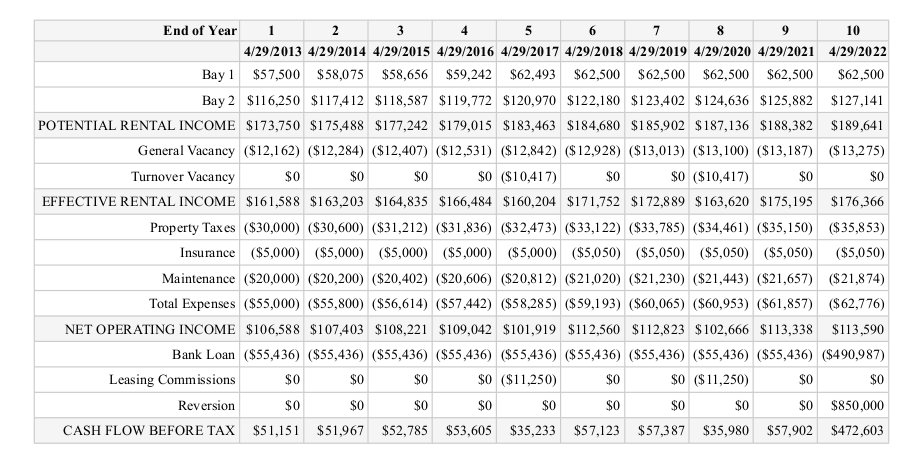

In order to give you a better idea of how to read these reports, let’s take a look at a pro forma income statement example:

Pro Forma Report courtesy of Property Metrics

In this pro forma report, the investor is looking at two income properties: Bay 1 and Bay 2. The pro forma is broken down into four major sections: potential rental income, effective rental income, net operating income, and cash flow before tax.

Let’s dig a bit deeper into each of these categories:

Potential Rental Income

This section is — you guessed it — how much rental income each property can potentially bring in. This is essentially the rent you’d be charging your tenants. However, potential rental income doesn’t take any other factors into consideration, like vacancy, so it isn’t an accurate representation of how much money you’ll actually pocket in rental income.

Effective Rental Income

Effective rental income takes the potential rental income and incorporates a vacancy allowance. A vacancy allowance, which includes general vacancy (when a property isn’t rented) and turnover vacancy (when a property is in between tenants), accounts for lost rental income while a property doesn’t have a tenant and is important to consider when evaluating rental income.

Your effective rental income is the money you’ll actually collect from your investment property after factoring in vacancies. It is a much more realistic number to work with when trying to determine profitability.

Net Operating Income

So you’ve figured out how much you’ll make in rental income. But not all of that is profit. In order to figure out your net operating income, you need to subtract the costs of operating and maintaining the property. This includes things like property tax, insurance, and general maintenance and upkeep.

Cash Flow Before Tax

Once you’ve worked out your net operating income, you need to incorporate any additional payments you’ll make on the property, like a mortgage payment and leasing commissions, as well as any additional cash flow, like a reversion. After you’ve done that, you have your cash flow before tax, and that’s the number you need to look at to determine whether a property is a profitable and sound investment for your portfolio.

Read With Caution

It’s important that you’re careful when you read a pro forma on a potential rental property. It’s in a seller’s best interest to make their property look as appealing as possible; as a result, they might exaggerate certain figures, downplay others, or leave entire categories out in an effort to make the property look like a better investment than it actually is. When reading a seller’s pro forma, take everything with a grain of salt and make sure you read the report carefully to spot any inconsistencies.

To avoid the inaccuracies of a seller’s pro forma, you should create a buyer’s pro forma to get a better estimation of a property’s profitability. Make sure your pro forma examines the key profitability factors, like vacancy loss and operating expenses, as well as investment-specific factors, like property management, to get the most accurate estimation.

If you underestimate things like maintenance or operating costs, you could find yourself with a pro forma report that says profitable for a property that will put you in the red.

Once you’ve created your own pro forma, go through it line by line and really wrap your head around whether the numbers you’re using are realistic; if you underestimate things like maintenance or operating costs, you could find yourself with a pro forma report that says profitable for a property that will put you in the red.

Consult With a Property Manager

If you’re unsure of whether your cash flow projections are accurate, talk to a property manager. Property managers have vast experience in understanding how much a property costs to operate; they understand the market and can give you a more accurate idea of how much you can expect to spend on the property, what reasonable rents are for the area, and what kind of vacancies you’re likely to experience.

Understanding a property’s cash flow is one of the most important factors (if not the most important one) in deciding whether a property is a solid investment. And when you know how to properly read a real estate pro forma cash flow report, you’ll have the information you need to evaluate the property, its profitability, and whether it’s a sound investment to add to your portfolio.

Need help building or understanding a pro forma report for a potential property? Get in touch with LEAP today and our property management team will be glad to help you.